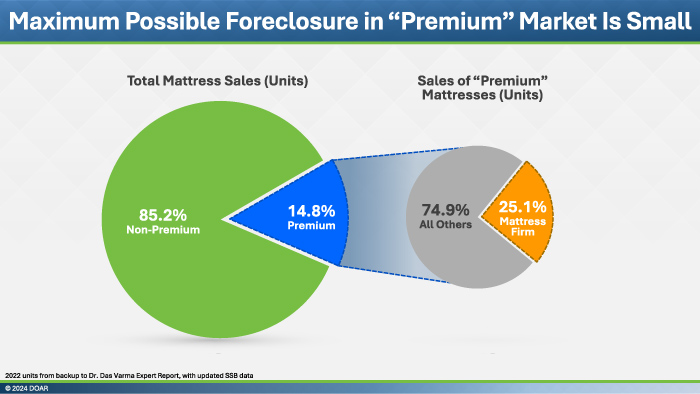

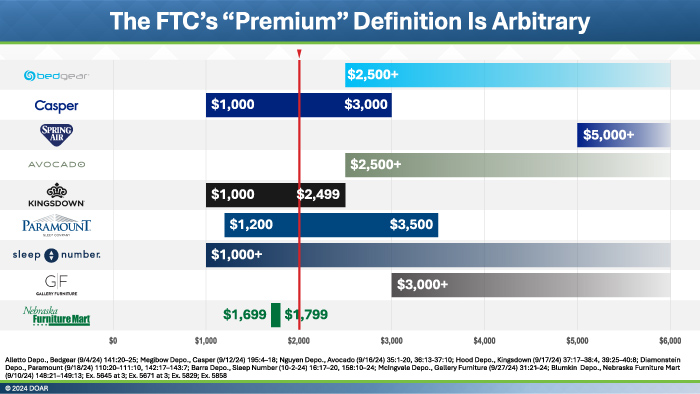

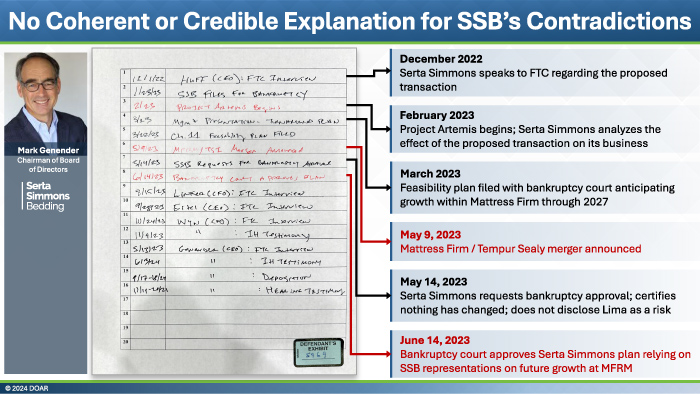

Following a two-week preliminary injunction hearing in the U.S. District Court for the Southern District of Texas, Judge Charles Eskridge denied the FTC’s bid to block Tempur Sealy International’s $4 billion acquisition of Mattress Firm, ruling that the agency failed to demonstrate a likelihood of anticompetitive harm. The FTC argued that the merger would reduce competition and limit consumer choice in the mattress market, particularly in the “premium” segment. The defense showed that the FTC’s market definition overstated competitive risk, that the predicted foreclosure scenarios were unsupported by real-world distribution dynamics, and that the merger was likely to generate efficiencies and consumer benefits.

Throughout the hearing, DOAR played a key role in helping the defense communicate complex economic and evidentiary issues with clarity and precision. DOAR’s graphics consultants and multimedia designers worked closely with the legal team to develop intuitive visual explanations of market structure, distribution channels, and the economic modeling underpinning the competitive analysis. DOAR also supported the trial team with evidence presentation, ensuring that data-heavy exhibits, demonstratives, and testimony were delivered seamlessly and in a manner that supported the defense narrative. Together, these efforts helped the Court understand the competitive realities of the mattress industry and reinforced the strength of Tempur Sealy and Mattress Firm’s arguments, contributing to the decisive victory against the FTC’s challenge.