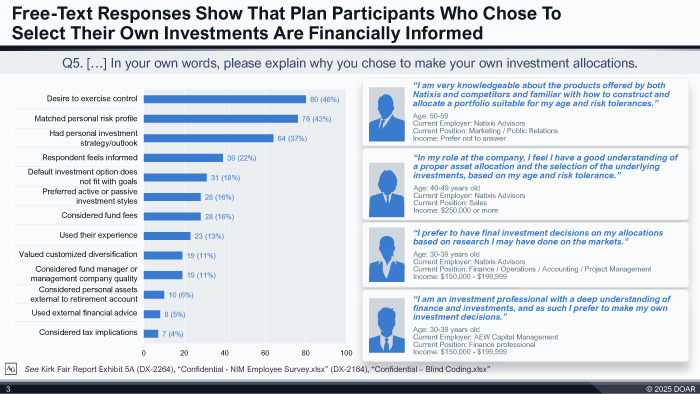

Following a two-week bench trial in the U.S. District Court for the District of Massachusetts, Judge Leo T. Sorokin ruled in favor of Natixis and its Retirement Committee on all counts. The lawsuit alleged that the committee improperly loaded the company’s 401(k) plan with proprietary Natixis funds that were more expensive and worse-performing than available alternatives. But after hearing evidence and witness testimony, the Court concluded that the plaintiffs failed to present proof that Natixis or its committee acted disloyally, prioritized corporate interests, or engaged in the kind of imprudent oversight necessary to establish a fiduciary breach.

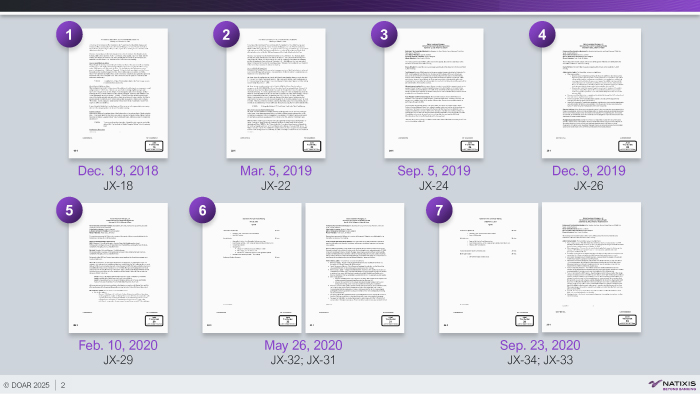

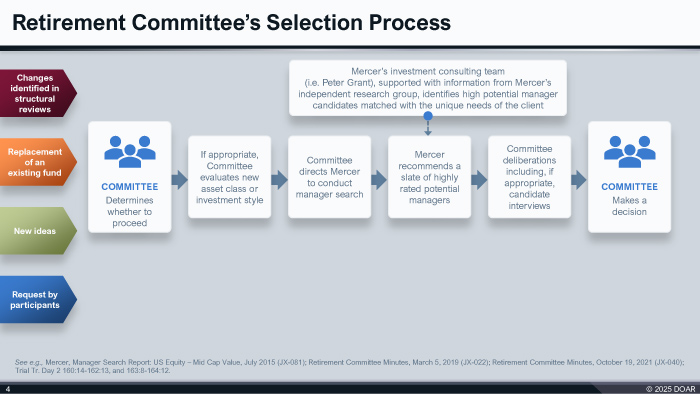

In a detailed written ruling, Judge Sorokin found that, while the committee was not “procedurally perfect,” its actions did not amount to actionable lapses. The Court credited evidence showing that the committee used a third-party investment consultant, regularly received and reviewed quarterly performance reports, and selected proprietary funds only when they were the highest-performing finalists under consideration. The judge rejected the idea that the plan was “plagued” by mismanagement and noted that even the committee’s admitted shortcomings did not result in measurable losses for participants, nor did they reflect disloyal or self-serving motives. As the Court observed, the record reflected a fiduciary body that was engaged, informed, and consistently updating the plan lineup, not one attempting to “sneak” proprietary funds into the plan at employees’ expense.

DOAR supported the defense throughout the proceedings, providing demonstrative development and courtroom evidence presentation to clearly explain complex investment decision-making processes and fiduciary oversight practices.